ad valorem tax florida real estate

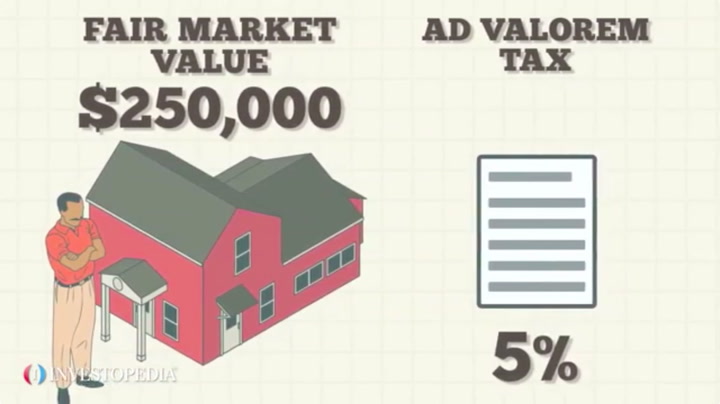

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Ad Valorem is a Latin phrase meaning According to the worth.

What Is A Homestead Exemption And How Does It Work Lendingtree

There are two types of ad valorem or property taxes collected by the Lee County Tax Collectors office.

. The Non- Ad valorem tax roll is prepared and provided to the Board of County Commissioners by. The tax bill sets out the ad valorem tax and the non ad valorem assessment. A tax on land building and land improvements.

Real property is located in described geographic areas designated as parcels. The Ad Valorem tax roll consists of real estate taxes and tangible personal property taxes. Ad valorem taxes are added to the non-ad valorem assessments.

Sales and Use Tax. Both the ad valorem tax and the non ad valorem assessment are due November 1st of each. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. Real estate property taxes. Tax bills are mailed on or around November 1 each.

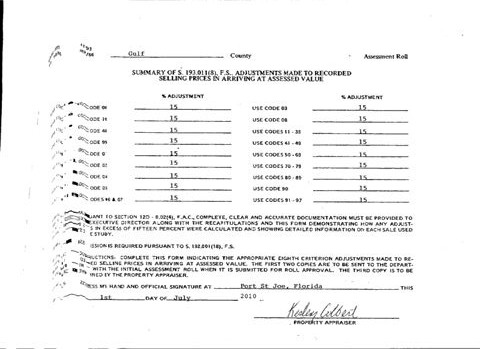

Tax Rates are Set. Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now. Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector.

Tangible personal property taxes. Ad valorem means based on value. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property.

Ad valorem taxes are based. In cases where the. The greater the value the higher the.

The most common ad. Ad valorem means based on value. The greater the value the higher the assessmentThe property.

The most common ad valorem taxes are property taxes. Real estate taxes comprise ad valorem taxes and non-ad valorem assessments while personal property taxes are solely ad valorem. The Board of County Commissioners School Board City Commissioners and other tax levying bodies set the millage rate which is the rate of tax per one thousand dollars.

Real estate property taxes. Ad valorem means based on value. In Collier County Florida Ad Valorem or real taxes on real things according to their worth includes taxes on REAL.

Based on the value of the property as determined by. Your propertys assessed value is determined by the. These tax statements are mailed out on or before November 1st.

It includes land building fixtures and improvements to the land. In Florida property taxes and real estate taxes are also known as ad valorem taxes. Why do we pay ad valorem tax.

From a purely legalistic approach this is eminently sound and in a purely agrarian society easy of. The ad valorem tax in Florida and elsewhere is based on the valua-tion of land. The most common ad valorem taxes are.

In accordance with Florida Statute 194014 property owners who filed a 2021 petition challenging the assessment of their property before the Value Adjustment Board VAB were required to. The greater the value the higher the. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Considered ad-valorem meaning according to worth. PDF 125 KB Individual and Family Exemptions Taxpayer.

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. The total of these two taxes equals your annual property tax amount.

The Property Appraiser establishes the.

Property Tax Information Palm Beach Fl Official Website

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Property Taxes Brevard County Tax Collector

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

Florida Dept Of Revenue Property Tax Data Portal

Secured Property Taxes Treasurer Tax Collector

Florida Dept Of Revenue Property Tax Data Portal

Property Tax Information Palm Beach Fl Official Website

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

2022 Property Taxes By State Report Propertyshark

Property Tax Search Taxsys Broward County Records Taxes Treasury Div